We think investing is for everyone and there’s no better time to start than today. In just a few minutes you can be on your way towards growing your wealth and a bright future. With EasyVest, you’ll receive data-driven investing guidance and the support you need is available online.

What is EasyVest?

EasyVest is a robo-advisor investment service provided by Access Softek Advisory Services, LLC (a registered investment advisor) and DriveWealth LLC (a registered broker-dealer). First Tech has partnered with Access Softek and DriveWealth to bring you access to their investment services through Online Banking and the First Tech App. First Tech is not a registered investment advisor nor a broker-dealer and does not hold, maintain, or offer advice on these investment accounts.

Benefits of EasyVest

Accessible – Start with as little as $200.

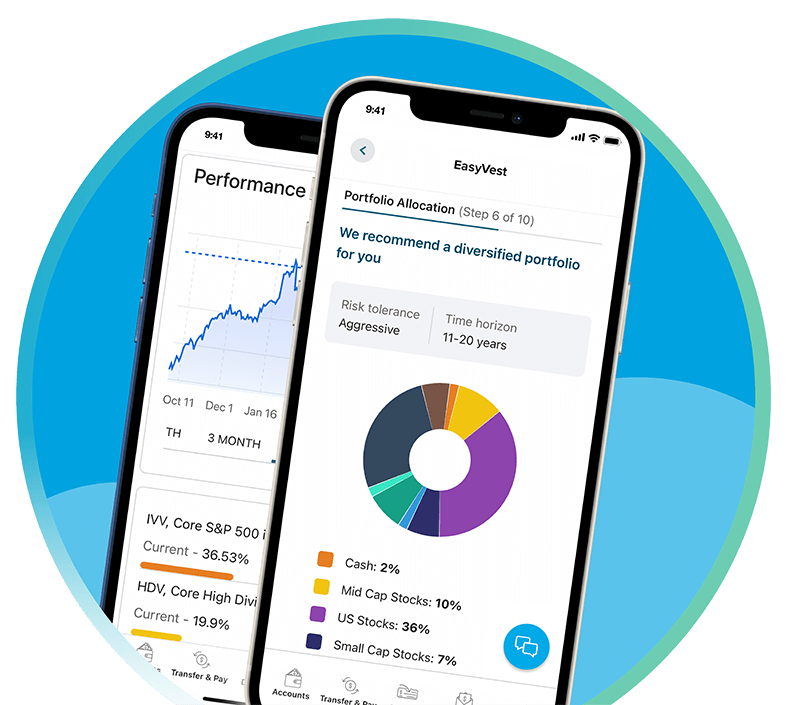

Digital – It's intuitive and automated. Let a robo-advisor do the work.

Custom – Investment portfolios that best fit your goals.

The details

- Open an Individual, Traditional IRA, Roth IRA, or Custodial investment account.

- Low annual fee of 0.45% of your total investment value or a minimum of $1.00 each month.

- First Tech members 18 years or older only.

- Conveniently accessible through Online Banking or the First Tech App.

- Set up reoccurring investment transfers from your First Tech checking or savings account on your schedule.

Start investing fast

- Log into Online Banking or the First Tech App. Select Investments > EasyVest > Get Started (this will take you to a service managed by Access Softek).

- Answer a few questions from EasyVest about your timeframe, risk tolerance and goals.

- EasyVest will suggest a diversified portfolio tailored to you.

- Fund your new investment account by a transfer from an existing First Tech savings or checking account.

Frequently asked questions

EasyVest is an investing solution powered by Access Softek Advisory Services, LLC a registered investment advisor. Brokerage services are offered through DriveWealth LLC, a registered broker-dealer (member FINRA/SIPC). First Technology Federal Credit Union (First Tech) is not registered as a registered investment advisor nor as a broker-dealer. Securities are not insured by credit union insurance, the NCUA, or any other government agency, are not deposits or obligations of the credit union, are not guaranteed by the credit union, and are subject to risks, including the possible loss of principal. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Access Softek’s internet-based services are designed to assist clients in achieving discrete financial goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation and do not incorporate specific investments that clients hold elsewhere.

|

Not Insured by NCUA or Any Other Government Agency |

Not Credit Union Guaranteed |

|

Not Credit Union Deposits or Obligations |

May Lose Value |