How Americans feel about their primary financial institution and why they might switch

The financial institutions you choose are important to your overall financial health. Having a trusted financial partner can help you manage your money easier, by building an emergency fund, establishing direct deposit and bill pay for quick payments.

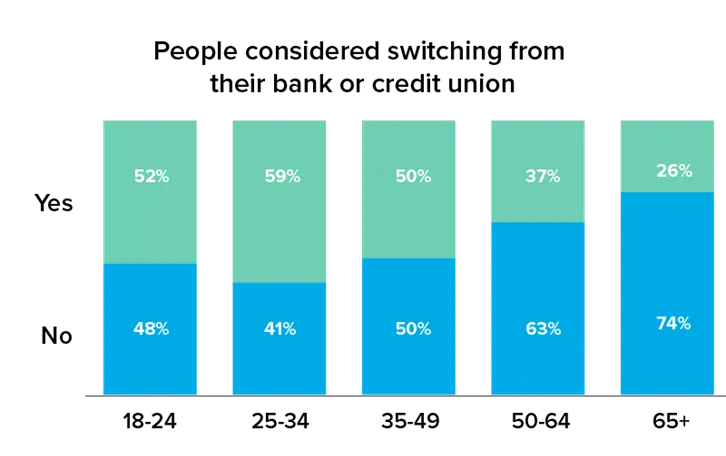

But nearly 50% of respondents have considered switching from their bank or credit union in the last two years, according to our recent Primary Financial Institutions Banking Survey. We polled banking customers from all age groups nationwide to see how they felt about their financial institutions.

So, what’s behind the desire to relocate funds?

Millennials are more likely to switch

Millennials between 25 and 34 years old were most likely to consider getting a new account, with 57% considering it in the last two years. Zoomers between 18 and 24 years old were the second most likely at 52%. While on the flip side, only 37% of customers between 50 and 64 years old had considered switching financial institutions recently.

67% of respondents who considered opening a new checking, savings, money market, or certificate in the last two years followed through.

That might come down to how long customers have held their accounts and how many accounts they own. The majority of our respondents—90%—said they have accounts at six or fewer financial institutions. When it comes to their primary bank accounts, how long they’ve stayed with one bank depends on their age, on average.

Only one out of three respondents overall reported having their primary checking account for 11 years or more. While 61% of people 65 years old or older had their checking account for 16 or more years.

It is a good idea to consider your financial needs periodically, regardless of how long you’ve been with one institution. For example, you may find your perfect credit card with another company, a better interest rate or improved customer service by comparing institutions.

What do people like best about their primary financial institution?

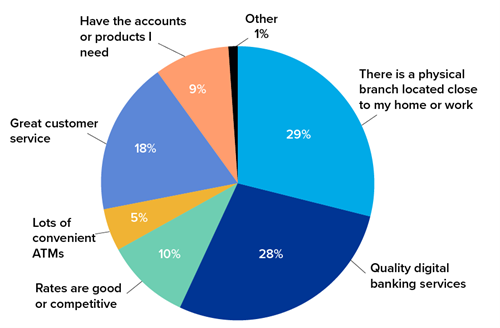

When asked what they like most about their primary financial institution, 29% said having a physical branch close to their home or workplace was key. A great digital banking experience keeps 28% of respondents with their current primary financial institution.

Your age might also impact what matters most to you in a bank or credit union. Our survey found 49% of those 50 years old or older wanted to be near a physical branch, while younger generations didn’t mind banking virtually.

Location might also play a factor, especially for those who bank with regional institutions. In the Southern region of the U.S., 32% reported being happy with their bank’s app, while only 18% of people in the Midwest felt the same.

Surprisingly, only 18% of people selected customer service as the thing they like most about their current primary financial institution.

When looking for a primary financial institution, customer service and accessibility matter. You may be able to compare banks and credit unions by evaluating the availability of branches, ATMs and online banking features. Ensure they have a user-friendly website and mobile app, as well. You can also try confirming that the financial institutions' customer service channels (phone, email, secure message, and live chat) are easily accessible and responsive.

People largely bank with big banks

Two-thirds of people said their primary checking account is held at one of the four largest banks in the country. Among millennials 25 to 34 years old, 77% used the largest banks as a primary financial institution. While 85% of people who earn $150,000 or more per year opt for the biggest banks.

Large national banks, regional financial institutions and credit unions often offer different benefits. While bigger banks may offer more physical locations and ATMs, you might find better services through a smaller bank or credit union. Smaller financial institutions can offer several advantages over large national banks for individuals and businesses:

- Personalized service: Smaller banks and credit unions often provide more personalized customer service, with dedicated in-person assistance. They can develop stronger relationships with account holders and address their specific needs.

- Local focus: Credit unions are often deeply rooted in the communities they serve. They understand the local economy and may be more inclined to support local businesses and community initiatives.

- Lower fees: Credit unions offer lower fees for account maintenance, ATM usage and other services compared to large national banks. They may also have fewer or no monthly account maintenance fees.

- Competitive interest rates: Credit unions may offer competitive rates on savings accounts, share certificates and loans. They often prioritize providing value to their members rather than maximizing profits.

- Owned by members: Credit unions are not-for-profit and owned by members instead of stockholders. That allows credit unions to put the needs of their members first.

To make sure you’re finding your ideal banking partner, it pays to shop around.

People want more from their financial institution

Largely, people want more than transactions from their banks. Only 6% of respondents disagreed or strongly disagreed that their primary financial institution should provide financial education and resources online.

Having a good source of trustworthy resources from your financial institution can be a boon to your financial health.

Credit unions, for example, often provide resources to their members to help them make informed financial decisions and improve their financial literacy. For example:

- Workshops: Many credit unions host workshops and webinars on topics such as budgeting, saving, investing, credit management and homeownership.

- Financial counseling: Some credit unions offer one-on-one financial counseling sessions with certified financial counselors. Members can discuss their financial goals and get personalized advice on how to achieve them.

- Educational materials: Credit unions often provide online resources that cover a wide range of financial topics.

- Financial calculators: Many credit union websites have financial calculators that help members calculate loan payments, savings goals, retirement savings and more.

Why aren't people switching banks?

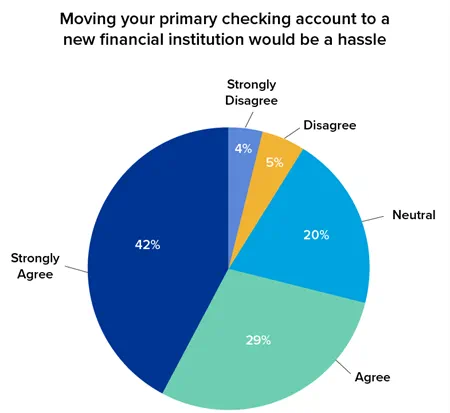

While half of our survey respondents reported considering switching, 71% felt it would be a hassle to move their primary checking account to a new financial institution.

Younger people, those between 24 and 34 years old, were most likely to switch. This may be due to the amount of time they’ve been banking with their current financial institution. Older people may feel more engrained with their financial institution as they’ve had time to set up direct deposits, bill pays and automatic withdrawals. They may also have more of these types of payments to manage.

Regardless of how much you have to manage, switching financial institutions can go smoothly with these steps:

- Opt for opening an account online: Most financial institutions let you apply online anytime.

- Set up online banking: Setting up online banking and downloading the app will make the transfer process go smoother.

- Update your direct deposits: Your HR department can help you quickly update your direct deposits once your new account is set up.

- Transfer automatic payments: Identify all automatic bill payments linked to your old account (e.g., rent, utilities, subscriptions) and update them with your new account information. You can usually do this online.

- Keep your old account open temporarily: Leave your old account open for a few weeks to ensure all outstanding checks and automatic payments have cleared. This will help avoid overdrafts or missed payments.

- Seek assistance: If you encounter any issues during the process, don't hesitate to contact both your old and new financial institutions for assistance. They can often provide guidance and support to make the switch smoother.

What would entice people to switch primary financial institutions?

So, what would convince people to make the switch? According to our survey, 37% of people would opt for a new financial institution if they moved. Customer service is also an important factor, with 39% of people feeling they’d want to get a new bank or credit union for better customer service.

But the largest incentives to make the move were benefits and rates, with 48% of people feeling that was a good reason to change financial institutions.

Recently, First Tech asked people what kind of interest rates they currently earn. Only 16% of people earned 3% or more on their primary savings, while 80% weren’t sure if they earned more than 0.50% Annual Percentage Yield, or APYAPY = Annual Percentage Yield. Rates effective as of 02/01/2025. Rate may change after the account is opened. Membership Savings has a 0.01% APY. First Tech Rewards Checking (FTRC) APY is 0.01%; First Tech Rewards Savings (FTRS) Qualified APY is 3.00% on all balances, FTRS Non-Qualified APY is 0.01% on all balances. $25 minimum opening deposit; Terms and conditions apply. Fees could reduce earnings on the account., on their checking account. When asked if they would be interested in learning more about a checking and savings account that earned a 4.00% interest or dividend rate, 79% of respondents said they would be interested, proving that rates really do matter when comparing financial institutions.

First Tech makes it easier to earn rewards. Along with cash back for minimum loan payments and credit card spending, with First Tech Rewards Checking® and First Tech Rewards Savings® earn up to Earn up to 0.01% Annual Percentage Yield (APY)0.01% APYAPY = Annual Percentage Yield. Rates effective as of 02/01/2025. Rate may change after the account is opened. Membership Savings has a 0.01% APY. First Tech Rewards Checking (FTRC) APY is 0.01%; First Tech Rewards Savings (FTRS) Qualified APY is 3.00% on all balances, FTRS Non-Qualified APY is 0.01% on all balances. $25 minimum opening deposit; Terms and conditions apply. Fees could reduce earnings on the account. . You can calculate your potential rewards, open an account, or schedule an appointment with a First Tech Representative to learn more.

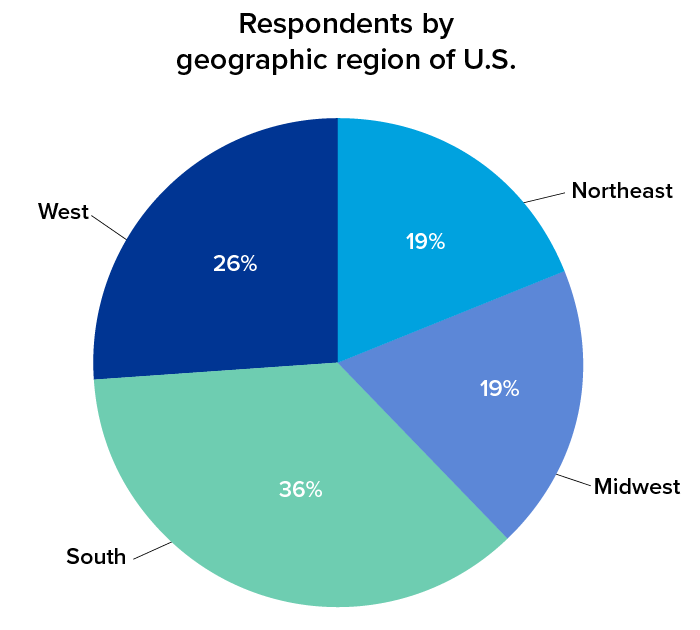

The findings of our Primary Financial Institution Survey are based on an online survey of about 1,000 consumers in the U.S. Participants who didn’t have a primary checking account were excluded from the survey. Conducted in September 2023, participants ranged in age from 18 to 82 years old. Around 30% of survey participants identified as male and 70% female.

Respondents by age

18-24: 5%

25-34: 34%

35-49: 39%

50-64: 16%

65+: 6%

Respondents by geographic region of U.S

Northeast: 5%

Midwest: 34%

South: 39%

West: 16%