Survey: Consumer

debt and credit cards

Debt is on the rise.

In 2022, consumers added over $1 trillion to their overall debt, mainly due to inflation and increased demand for goods. This debt increase is larger than we have seen in over a decade.

To better understand how consumers manage their debt in these uncertain financial times, we surveyed more than 1,000 people on their debt load, payment strategies and current worries.

Want to see how you compare (and what you can do about it)? Check out some of our key findings:

Most people worry about debt

2 out of 3 people

Worry about paying debt very frequently.

Of consumers with debt, nearly 2/3 surveyed said they worry about paying debt ‘very frequently’ or ‘often’. In fact, only 9% of respondents with debt said they ‘never’ worry about it. But you can make moves to curb the worry. For example, creating a SMART budget will help you realize your financial goals and prevent overspending. SMART stands for Specific, Measurable, Actionable, Relevant and Time-Bound. To create a SMART budget, write down measurable financial goals that are important to you and obtainable. Then, give yourself a deadline to reach those goals. By focusing on goals first, you’ll be better able to focus your spending.

Carrying a balance is common

Only 38% of respondents pay off their credit card balance in full each month. While 19% rarely, if ever, hit a balance of $0.

Older consumers are also more likely to carry a balance month-to-month than younger consumers. More than 40% of respondents between 25 and 34-years-old pay off their credit card each month, compared to 30% of those 50 to 64-years-old.

Paying the minimum balance on your credit card might seem like an attractive option because it lowers your monthly payment, but it can actually end up costing you a lot more in the long run. When you factor in your credit card’s high interest rate, you're barely making a dent in the principal amount owed. As a result, it can take months—or even years—to pay off the balance, and you'll end up paying a lot more in interest charges over time.

Want to pay off your credit card debt? Using your current amount due and interest rate, our calculator will help you determine how long it will take to reach a $0 balance.

Half of consumers owe more than $1,000 in credit card debt

Over 50% of respondents carry more than a $1,000 balance on their credit cards. Nearly a quarter owe more than $5,000.

While most of us deal with debt at some point in our lives, carrying a credit card balance from month-to-month can cause your debt load to spiral out of control. Thankfully, you can take steps to pay off your debt.

One popular debt-reduction strategy is the snowball method. Here's how it works: you start by making a list of all of your debts, from smallest to largest. Then, focus on paying off the smallest debt first while making the minimum payments on your other debts. Once you've paid off the smallest debt, you move on to the next smallest debt, and so on.

As you pay off each debt, you gain momentum and your payments become like a snowball rolling down a hill, getting bigger and bigger. This can help you stay motivated and feel a sense of accomplishment as you see your debts gradually disappearing.

Consumers are transferring credit card balances

More than 35% of consumers have transferred balances between credit cards in the last year. Why did they transfer balances?

- 34% took advantage of a promotional rate.

- 31% wanted more time to pay off a balance.

- 30% took advantage of a lower interest rate on another credit card.

Transferring balances may help you save money on interest, but there are a couple of things to consider first.

Many credit card companies offer an introductory 0% interest rate for a certain period, usually ranging from six months to a year. After the introductory period, the interest rate could skyrocket. To maximize your savings, make sure you have a plan for paying off your debt during the promotional period.

Some companies may also charge a balance transfer fee. Read the fine print to make sure you’re factoring in fees to determine if you’re getting the best deal.

Most consumers consider consolidating debt

According to our survey, more than half of consumers have seriously considered paying off a debt in the last year. Many (38%) have considered consolidating debt.

A debt consolidation loan is a type of loan that combines your existing debts, such as credit card balances, personal loans and other debts, into a single loan with a lower interest rate. This means you can make one monthly payment to the lender instead of multiple payments to different creditors, simplifying your debt management. Debt consolidation loans may also offer lower monthly payments, making it easier to manage your finances and pay off your debt over time. However, debt consolidation loans may not be the best solution for everyone, as they can result in longer repayment periods and higher total interest costs over time.

Deciding when to consolidate debt can be complicated. The First Tech Federal Credit Union team can help you create a personalized plan that fits your needs.

Consumers are taking out cash advances

In the last two years, 33% of respondents have taken a cash advance at least once.

A cash advance is essentially a short-term loan using your credit card. The amount is often limited to a certain percentage of your credit limit. You’ll also likely be hit by a cash advance fee, which is usually a percentage of the amount borrowed.

Interest on cash advances also begins accruing immediately. The interest rate on a cash advance is usually higher than the standard interest rate for purchases.

A cash advance can be an expensive option. If you need to borrow money, you may find better rates through a personal loan or a 401(k) loan. Before taking out a cash advance, compare lending rates from other financial institutions, like your credit union, to ensure you’re getting the best deal possible.

1 in 3 people

have taken a cash advance in the last two years.

Rewards cards are popular

The good news: most respondents (84%) are using a rewards card with 41% of them getting cash back and 32% getting points.

Using a rewards credit card over a traditional credit card can be beneficial for a few reasons. First, as the name suggests, rewards credit cards offer rewards for usage, which can help you save money on everyday expenses or earn points or miles toward travel so you get more value out of your spending.

Rewards credit cards also often come with additional perks or benefits, such as purchase protection or access to exclusive events, that traditional credit cards may not offer. These perks can add up to significant savings over time.

And some consumers are using their rewards to pay off debt. Almost half of respondents have used credit

card rewards to pay bills and an additional 14% plan to in the future.

While taking advantage of rewards can be a smart way to earn more on spending you’d already planned for, relying on rewards to pay your credit card bill could be risky. It is better to set a monthly credit spending limit you can comfortably afford to repay and view any cash back as an extra “perk,” rather than a need.

Of course, it's also important to note that rewards credit cards may not be the best option for everyone. If you tend to carry a balance on your credit card from month to month, the interest charges may quickly offset any rewards or benefits you earn. Additionally, rewards credit cards may come with higher annual fees or interest rates compared to traditional credit cards. Compare the benefits against the costs to find your perfect credit card.

Almost 50%

have used credit card rewards to pay bills.

Take charge of your financial future

About the survey

Respondents by age

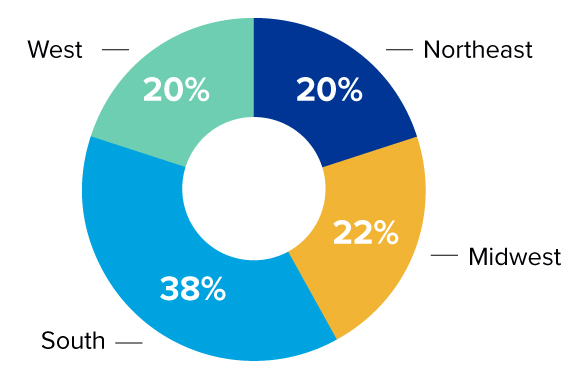

Respondents by geographic region of U.S.